KW Shariah Compliance

Screening Methodology: AAOIFI

NOT HALAL

Last Updated: August 13, 2025

Report Source: 2025 2nd Quarter Report

Kennedy-Wilson Holdings Inc. Stock Analysis KW

Kennedy-Wilson Holdings, Inc. operates as a real estate investment company, which engages in the ownership, operation, development, and investment in real estate properties. The company is headquartered in Beverly Hills, California and currently employs 246 full-time employees. The company went IPO on 2007-11-15. The firm owns, operates, and invests in real estate both on its own and through its investment management platform. The company focuses on investing in the rental housing sector (both market rate and affordable units) and industrial properties, and originating, managing and servicing real estate loans (primarily senior construction loans secured by multifamily and student housing properties that are being developed by institutional sponsors throughout the United States). The company operates in two segments: Consolidated Portfolio and Co-Investment Portfolio. Its Consolidated Portfolio consists of investments in real estate and real estate-related assets that it has made and consolidated on its balance sheet, primarily multifamily communities. Under the Co-Investment Portfolio, it invests capital on behalf of its partners in real estate and real estate-related assets, primarily construction loans, through its Co-Investment Portfolio.

Read More Kennedy-Wilson Holdings Inc (KW) Chart

Kennedy-Wilson Holdings Inc (KW) vs CBOE Volatility Index (VIX) Comparative Returns

Analysis of Kennedy-Wilson Holdings Inc (KW) stock performance compared to the broader market (CBOE Volatility Index (VIX)) across multiple timeframes.

YTD Performance

- Kennedy-Wilson ... (KW...) -13.81%

- CBOE Volatility Index (VIX) -16.43%

Kennedy-Wilson ... Outperformed CBOE Volatility Index (VIX) by 2.62%

1Y Performance

- Kennedy-Wilson ... (KW...) -21.44%

- CBOE Volatility Index (VIX) -7.35%

Kennedy-Wilson ... Underperformed CBOE Volatility Index (VIX) by 14.09%

3Y Performance

- Kennedy-Wilson ... (KW...) -47.31%

- CBOE Volatility Index (VIX) -44.68%

Kennedy-Wilson ... Underperformed CBOE Volatility Index (VIX) by 2.63%

5Y Performance

- Kennedy-Wilson ... (KW...) -39.87%

- CBOE Volatility Index (VIX) -36.85%

Kennedy-Wilson ... Underperformed CBOE Volatility Index (VIX) by 3.02%

Key Statistics of Kennedy-Wilson Holdings Inc (KW)

Key statistics in the stock market are essential financial indicators that measure a company's performance, valuation, profitability, and risk.

Today's Range

Today's Open

$8.55Volume

794.93KP/E Ratio (TTM)

-52 Week Range

Market Cap

1.20BAvg. Volume

690.84KDividend Yield

9.89%Financial Metrics & Statements of Kennedy-Wilson Holdings Inc (KW)

Super Investors Invested in Kennedy-Wilson Holdings Inc (KW)

Super Investors are top-performing investors known for their exceptional market strategies and long-term success in wealth creation.

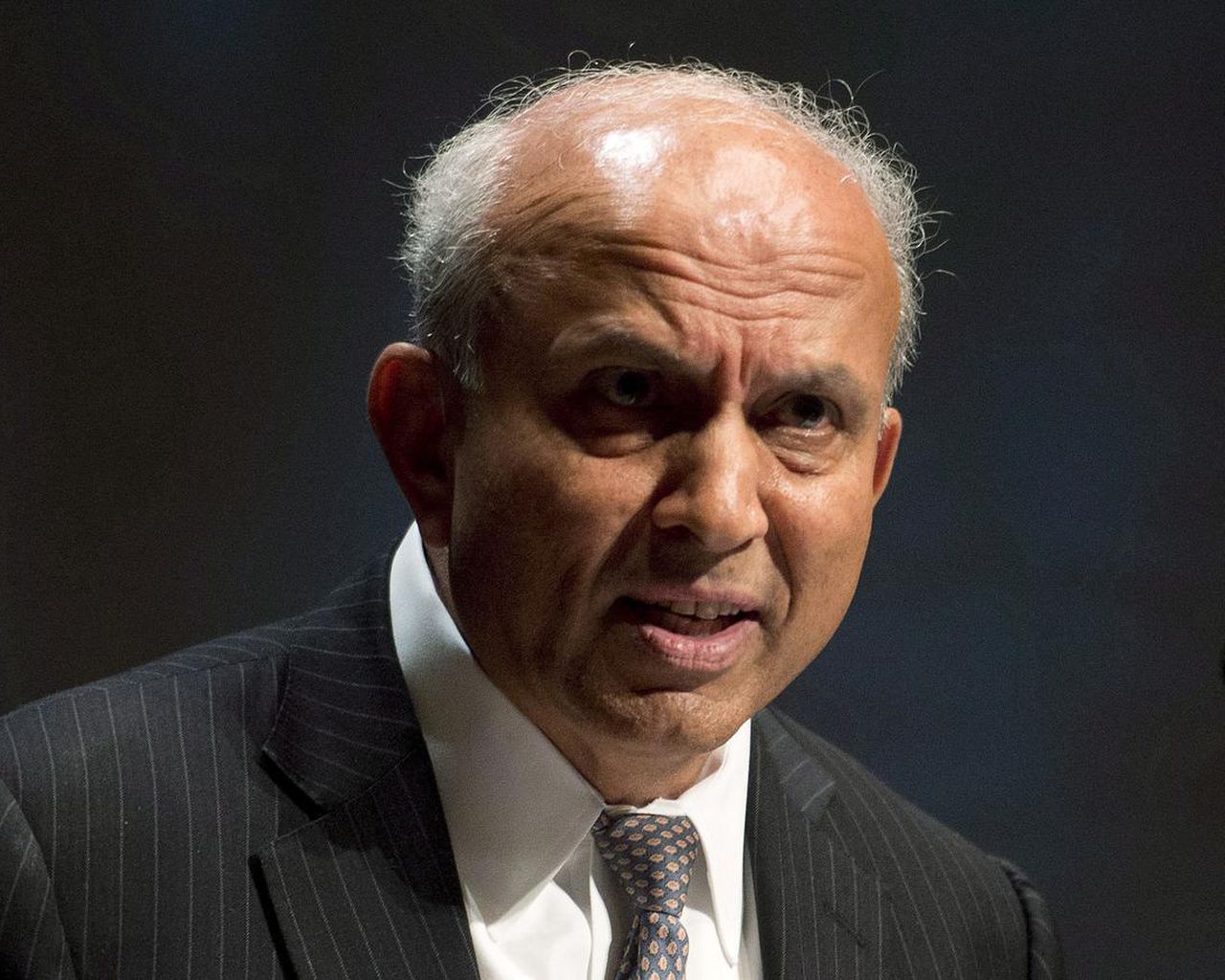

Prem Watsa

% Portfolio:

6.26 Recent Activity:-

Arnold Van Den Berg

% Portfolio:

1.67 Recent Activity:23.85%

Joel Greenblatt

% Portfolio:

0 Recent Activity:-100.00%

Jefferies Group

% Portfolio:

0 Recent Activity:-100.00%

Community-Curated Collections with Kennedy-Wilson Holdings Inc (KW)

View AllCommunity-Curated Collections are thoughtfully selected groups of stocks or assets, curated by investors and experts based on shared themes, values, or investment strategies.

shariah list nifty 50

By trading view

2158 Followers

HALAL STOCK of india

By Aasif Khan

1923 Followers

My Halal AI Stocks Technology - 2024

By Doniyor Akhmadjon

667 Followers

Recent Halal Top Performers US

By Doniyor Akhmadjon

448 Followers

Dow Jones Industrial Average Index

By Dilnoza Mirsaidova

237 Followers

Zero Debt Stocks in India

By Javokhir Suyundikov

124 Followers

1st HALAL NIFTY SMALLCAP 250

By Abdul Mannan

116 Followers

Halal stocks in INDIA

By Altaf Khan

114 Followers

IT Sector Stocks in India

By Javokhir Suyundikov

107 Followers

Halal Divident Stock

By Monirul Islam

104 Followers

FAQ's for Kennedy-Wilson Holdings Inc (KW)

Halal stocks refer to shares of companies that comply with Islamic finance principles, meaning they do not engage in businesses related to alcohol, gambling, pork, or interest-based financial services.

Alternate Halal Stocks for Kennedy-Wilson Holdings Inc (KW)

Related Halal Stocks are Shariah-compliant companies that align with Islamic investment principles, avoiding prohibited industries like alcohol, gambling, and interest-based finance.