BB.TO Shariah Compliance

Screening Methodology: AAOIFI

LOCKED

BlackBerry Ltd. Stock Analysis BB.TO

BlackBerry Ltd. engages in the provision of intelligent security software and services. The company is headquartered in Waterloo, Ontario and currently employs 1,820 full-time employees. The firm delivers operational resiliency with the certified platform for mobile fortification, mission-critical communications, and critical events management. The company operates in three segments: Secure Communications, IoT, and Licensing. The Secure Communications segment consists of BlackBerry UEM, BlackBerry AtHoc, and BlackBerry SecuSUITE. The firm's endpoint management platform includes BlackBerry UEM, BlackBerry Dynamics, and BlackBerry Workspaces solutions. The IoT segment consists of BlackBerry QNX, BlackBerry Certicom, BlackBerry Radar, BlackBerry IVY, and other IoT applications. The Licensing segment consists of the Company’s intellectual property arrangements and settlement awards.

Read More BB.TO Chart

Key Statistics

Key statistics in the stock market are essential financial indicators that measure a company's performance, valuation, profitability, and risk.

Today's Range

Today's Open

CAD5.26Volume

1.24MP/E Ratio (TTM)

-52 Week Range

Market Cap

3.24BAvg. Volume

1.55MDividend Yield

-Super Investors

Super Investors are top-performing investors known for their exceptional market strategies and long-term success in wealth creation.

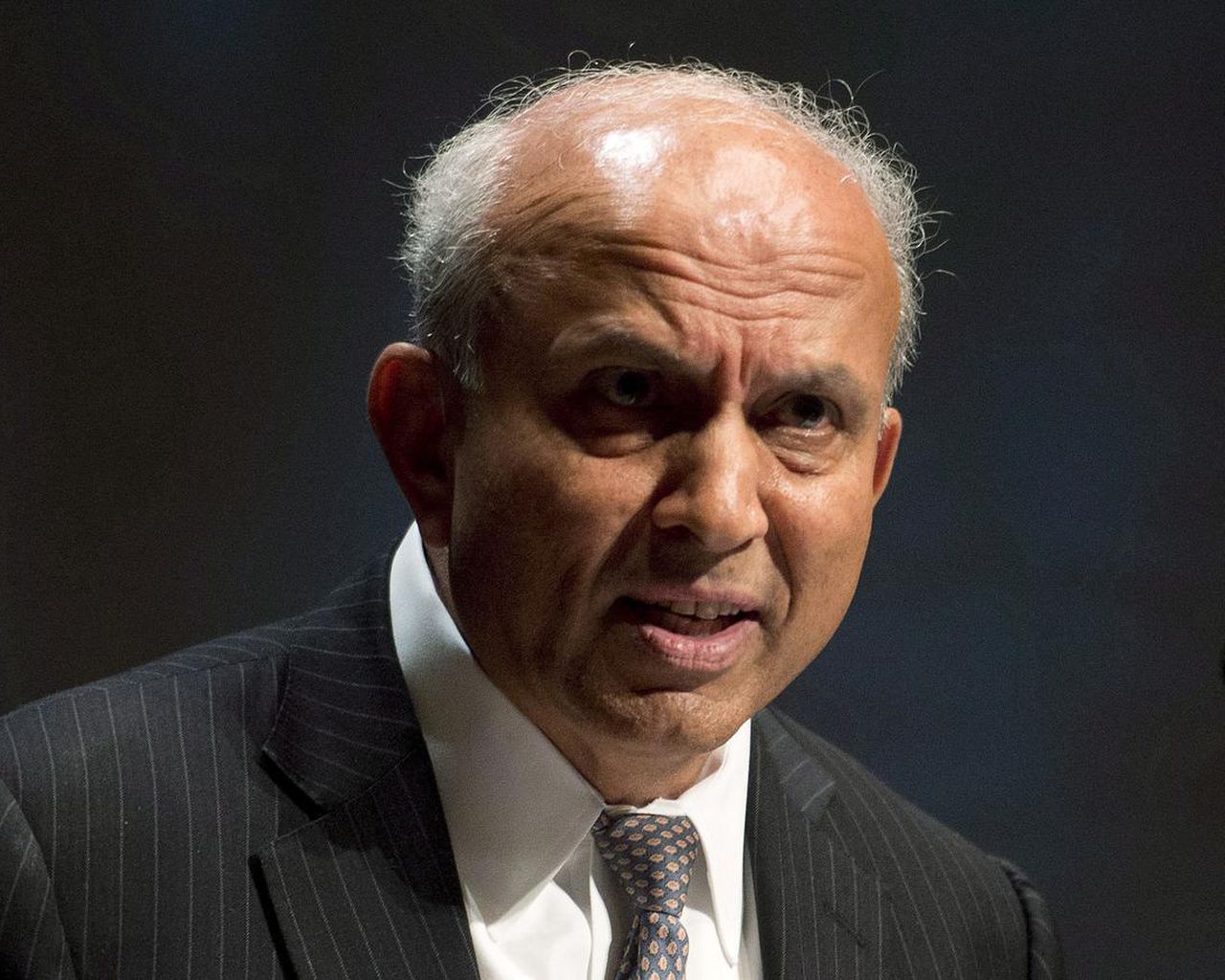

Prem Watsa

% Portfolio:

11.35 Recent Activity:-

Joel Greenblatt

% Portfolio:

<0.01 Recent Activity:327.47%

Kahn Brothers

% Portfolio:

0 Recent Activity:-100.00%

Community-Curated Collections ( With BB.TO )

View AllCommunity-Curated Collections are thoughtfully selected groups of stocks or assets, curated by investors and experts based on shared themes, values, or investment strategies.

FAQ's

Halal stocks refer to shares of companies that comply with Islamic finance principles, meaning they do not engage in businesses related to alcohol, gambling, pork, or interest-based financial services.

Alternate Halal Stocks

Related Halal Stocks are Shariah-compliant companies that align with Islamic investment principles, avoiding prohibited industries like alcohol, gambling, and interest-based finance.